Futa Tax Increase 2025. In 2025, only the first $160,200 of your earnings are subject to the social security tax. 1.45% for the employee plus 1.45% for the employer;

California, connecticut, new york, and the us virgin islands might be subject to a federal unemployment tax act credit reduction for 2025, according to a table. In 2025, the first $168,600 is subject to the tax.

The net futa tax rate for 2025 will increase from 0.90% in 2025 to 1.20% in 2025 for california and new york and from 4.20% in 2025 to 4.50% in 2025 for the u.s.

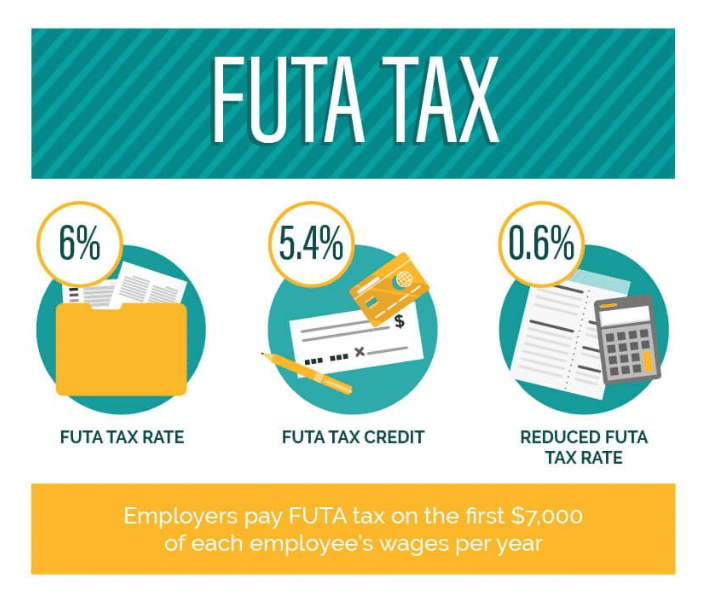

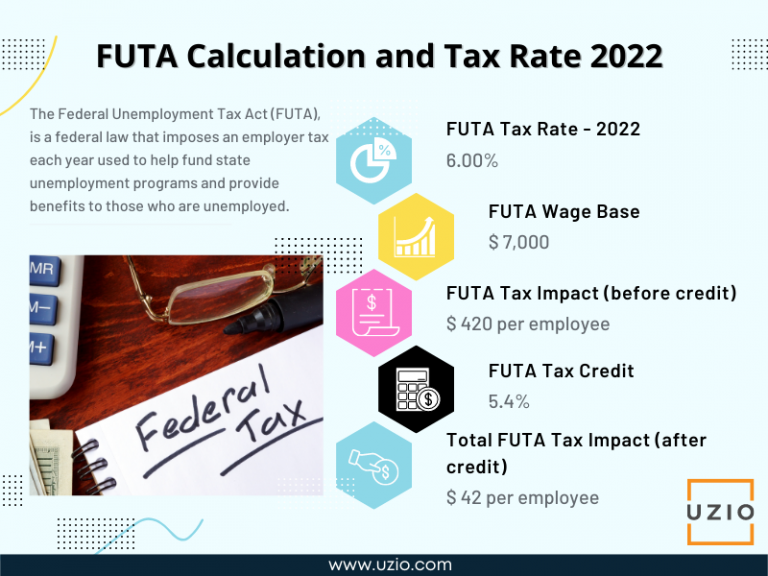

FUTA Federal Unemployment Tax Act What is FUTA? The Federal, The standard futa tax rate is 6.0% of the first $7,000 paid to each employee annually, but this can effectively be reduced to 0.6% with state unemployment tax credits. This publication also provides employers, including employers in the usvi and puerto rico, with a summary of their responsibilities in connection with the tax under the federal.

What Is FUTA Tax? It Business mind, Therefore, employers shouldn't pay more than $420 annually for each. 1.45% for the employee plus 1.45% for the employer;

What Is FUTA? The Federal Unemployment Tax Act Explained, The federal unemployment tax act (futa), which imposes a federal employer tax used to fund state workforce agencies, is expected to undergo significant changes in 2025. Fica tax is still 15.3%, and futa tax is still 6%.

What is FUTA & How Much Do I Need To Pay?, The additional futa tax owed due to the futa credit reduction will be shown on the 2025 form 940, and the increase in futa tax is due on january 31,. January 31, 2025 (for the fourth.

FUTA Tax Exemption What Businesses Are Exempt from FUTA?, The net futa tax rate for 2025 will increase from 0.90% in 2025 to 1.20% in 2025 for california and new york and from 4.20% in 2025 to 4.50% in 2025 for the u.s. Therefore, employers shouldn't pay more than $420 annually for each.

Everything You Need to Know About the FUTA Tax ZipBooks, [4] for both years, there is. The 2025 futa wage limit of $7,000 has.

Complete Guide to FUTA tax, October 13, 2025 · 1 minute read. The federal unemployment tax act (futa), which imposes a federal employer tax used to fund state workforce agencies, is expected to undergo significant changes in 2025.

FUTA Federal Unemployment Tax Act Share Award Q, BEST COMMENTS Paxcowg, Payroll tax rates have remained unchanged for 2025. States are required to maintain a sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa).

FUTA Tax How to Calculate and Understand Employer’s Obligations UZIO Inc, Fica tax is still 15.3%, and futa tax is still 6%. In 2025, key changes are expected to be made in the federal unemployment tax act (futa) that will introduce new exemptions and exclusions.

/GettyImages-1058294748-e446b1a3425c4300b80b857b6f763b0e.jpg)

What Is FUTA?, California, connecticut, new york, and the us virgin islands might be subject to a federal unemployment tax act credit reduction for 2025, according to a table. The 2025 futa wage limit of $7,000 has.

The additional futa tax owed due to the futa credit reduction will be shown on the 2025 form 940, and the increase in futa tax is due on january 31,.

Several states have released their state unemployment insurance taxable wage bases for 2025 in a chart provided and updated by payo.